Practical Guide to the EB5 Visa for UK Investors

Wiki Article

Navigating the EB5 Visa Process: A Detailed Overview for UK Citizens

The EB5 Visa procedure provides a path to united state residency for UK residents with financial investment. Comprehending the steps involved is crucial for an effective application. From determining the right financial investment option to steering through the intricacies of documentation, each stage has its challenges. As individuals begin this journey, they must be conscious of the eligibility requirements and the possible hurdles that might arise. What approaches can ensure a smoother transition right into this procedure?Recognizing the EB5 Visa Program

What makes the EB5 Visa Program an attractive option for investors? This program provides a pathway to united state long-term residency with financial investment in job-creating enterprises. By investing a minimum of $900,000 in targeted work locations or $1 - EB5 Visa.8 million in various other regions, international capitalists can safeguard a Permit on their own and their instant family. The EB5 Visa is appealing as a result of its twin advantages: prospective return on financial investment and the opportunity for a stable life in the United States. Additionally, the program permits capitalists to join a flourishing economy and add to work production, enhancing their charm as accountable worldwide citizens. The prospect of a simplified immigration procedure better solidifies the program's attractiveness, making it an engaging choice for severalQualification Demands for UK People

To qualify for the EB5 visa, UK residents should fulfill specific investment quantity criteria, normally needing a minimum investment in an U.S. service. In addition, candidates must show the lawful source of their funds to guarantee conformity with immigration regulations. Understanding these demands is important for a successful application process.Financial Investment Quantity Criteria

Recognizing the investment quantity criteria is necessary for UK residents looking for to join the EB5 visa program. The minimum financial investment needed normally stands at $1 million in a brand-new business. This quantity is minimized to $500,000 if the investment is made in a targeted employment area (TEA), which is identified by high joblessness or reduced populace thickness. This distinction is crucial, as it supplies an opportunity for investors to add to financially troubled areas while also satisfying visa requirements. It is essential for potential financiers to be familiar with these monetary thresholds, as they directly affect eligibility and the total success of their EB5 application process. Cautious consideration of the investment amount can greatly impact the resultResource of Funds

Financial Investment Options: Straight vs. Regional Center

Guiding with the investment landscape of the EB5 visa program exposes two primary alternatives for UK residents: direct financial investments and local facility projects. Direct financial investments include purchasing a brand-new business, where the capitalist generally takes an active role in the service procedures. This path may use greater returns however requires more hands-on monitoring and a comprehensive understanding of the service landscape.On the other hand, regional facility projects allow investors to add to pre-approved entities that handle multiple EB5 financial investments. This choice normally calls for less participation from the financier and can offer a more easy investment experience. Both opportunities have unique benefits and challenges, demanding careful factor to consider based on individual economic objectives and take the chance of tolerance.

The Minimum Investment Amount

The EB5 visa process calls for a minimum investment quantity that differs relying on the chosen investment course. For those selecting a Regional Facility, the common investment limit is usually greater as a result of the nature of these projects (EB5 Visa For UK Citizens). EB5 Visa. Recognizing these economic needs is essential for UK residents seeking to browse the EB5 program properlyInvestment Quantity Summary

Comprehending the financial requirements of the EB5 visa process is crucial for UK people considering this immigration path. The EB5 visa program generally mandates a minimum investment quantity of $1 million in a new business. This amount can be reduced to $500,000 if the financial investment is made in a targeted employment area (TEA), which is characterized by high joblessness or country location. These investment thresholds are important for receiving the visa, as they directly affect the qualification of prospects. Potential investors have to thoroughly evaluate their economic capabilities and warranty compliance with the well established needs. This financial investment not only unlocks to united state residency but likewise adds to economic development and task production within the nation.Regional Center Alternative

While exploring the EB5 visa choices, financiers may find the Regional Center program specifically appealing due to its reduced minimum financial investment demand. As of October 2023, the minimum financial investment quantity for the Regional Center alternative is evaluated $800,000, substantially less than the $1,050,000 required for direct financial investments in new business. This lowered threshold permits more capitalists to get involved, specifically those looking for a much more passive financial investment approach. The Regional Center program likewise offers the advantage of job creation with pooled financial investments in bigger jobs, which can bring about a smoother course to long-term residency. For UK citizens taking into consideration the EB5 visa, the Regional Center alternative provides a compelling financial incentive together with potential development possibilities.The Application Process: Step-by-Step

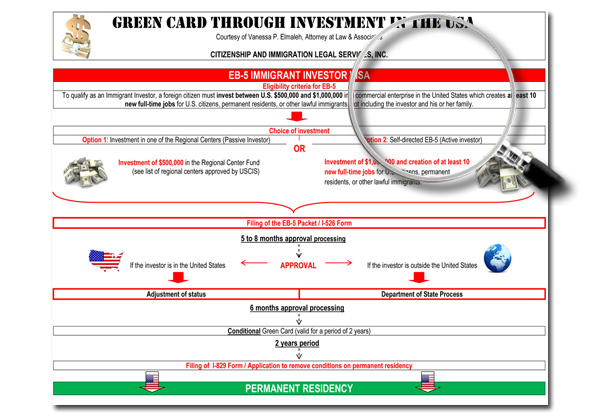

Maneuvering the EB5 visa procedure requires mindful interest to information, as each action is necessary for success. Initially, candidates need to select either a regional center or a direct investment option, depending on their investment strategy. Next, they should collect essential documents, consisting of evidence of funds and a comprehensive organization strategy. As soon as prepared, applicants send Type I-526, the Immigrant Petition by Alien Investor, to the USA Citizenship and Migration Provider (USCIS) After authorization, applicants can look for a visa at an U.S. consular office or change their condition if already in the U.S. Upon arrival, capitalists must preserve their financial investment for a designated duration, generally 2 years, to satisfy the EB5 requirements.Common Challenges and Just How to Overcome Them

Preserving Your EB5 Standing and Course to Citizenship

Successfully keeping EB5 status is crucial for investors intending to attain long-term residency in the USA. To preserve this condition, investors must assure that their funding financial investment remains at risk which the financial investment creates the needed variety of jobs within the specified timeframe. Routine communication with the local center or task managers is crucial to remain notified regarding conformity and performance metrics.Capitalists have to file Type I-829, the Petition by Entrepreneur to Get Rid Of Conditions, within the 90-day window prior to the two-year wedding anniversary of acquiring check that conditional residency. This petition calls for documents demonstrating that all investment conditions have actually been satisfied. Lastly, maintaining a clean legal document and sticking to U.S. laws will markedly enhance the course to ultimate citizenship.

Often Asked Inquiries

Just how Lengthy Does the EB5 Visa Process Normally Take?

The EB5 visa procedure generally takes about 12 to 24 months. Factors such as refining times at United state Citizenship and Immigration Solutions and the quantity of applications can create variations in this duration.Can Family Members Members Join Me on My EB5 Visa?

Yes, household participants can come with an individual on an EB5 visa. This consists of partners and children under 21, allowing them to get irreversible residency alongside the main applicant during the visa procedure.What Takes place if My Investment Stops working?

The individual might lose the invested resources and possibly endanger their visa condition if the investment fails. They ought to seek advice from a migration lawyer to check out choices for keeping residency or resolving the investment loss.Exist Age Limitations for Dependents Applying With Me?

There are age constraints for dependents using with the primary applicant. Just single youngsters under 21 years old can qualify as dependents, suggesting those over this age should apply individually for their own visas.Can I Operate In the U.S. With an EB5 Visa?

A specific holding an EB-5 visa is allowed to work in the USA. This visa grants them the ability to take part in employment possibility, as it results in permanent residency standing upon satisfying the demands.To qualify for the EB5 visa, UK citizens should meet certain investment amount standards, usually calling for a minimal investment in a United state company. Steering through the financial investment landscape of the EB5 visa program reveals 2 primary options for UK people: straight financial investments and local center tasks. The EB5 visa procedure calls for a minimum investment amount that differs depending on the chosen financial investment course - Investor Visa. As of October 2023, the minimum financial investment amount for the Regional Center option is set at $800,000, considerably much less than the $1,050,000 required for direct financial investments in new commercial enterprises. To maintain this standing, capitalists have to ensure that their capital investment continues to be at danger and that the investment develops the required number of jobs within the stated duration

Report this wiki page